Be Canny with Cashflow

In the race to have everything done before the Christmas closedown, make sure you take some time to look at your cashflow and plan for the new year. January is a month with some key tax dates, with a lot of things falling due on 15 January in particular.

As well as the usual PAYE return dates, GST returns for both November and December are due in January. And for many, January and February can be big months for provisional tax. Plan ahead to make sure you're covered. Contact us if you think cashflow will be tight and you'd like to talk through options for how to manage it best.

As well as the usual PAYE return dates, GST returns for both November and December are due in January. And for many, January and February can be big months for provisional tax. Plan ahead to make sure you're covered. Contact us if you think cashflow will be tight and you'd like to talk through options for how to manage it best.

Gifts and Deductions

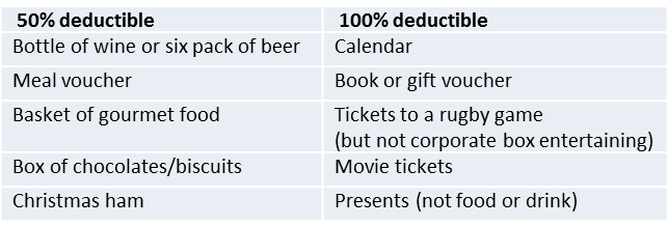

The rule of thumb with gifts is that if they consist of food or drink, you can only claim 50% of the expense as a tax deduction. If you are giving out gift baskets or hampers and some of the contents are food or drink, but not all, the food or drink items are 50% deductible but the other gift items are 100% deductible. When you come to claim the tax deduction, you will need to apportion the expense between the 100% deductible items and the 50% deductible items. If you are giving gifts at Christmas time, remember that some gifts will be fully deductible while others will only be 50%. Use these examples as a guide