Tax is payable on rental income.....mostly

If you receive income, you must pay tax. So if you have rental income, you have to pay tax on it, right?

Maybe, maybe not – if you get rent from boarders or homestays.

Boarders and Homestays

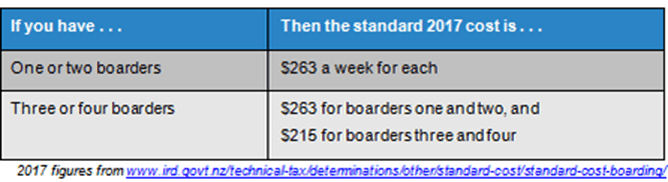

When you get income from boarders or homestays, your tax position depends on how many boarders you have, and how much you can charge, compared with the IRD’s standard-cost method. In other words:

If you charge less than standard-cost figures for four or few boarders, you don’t have to declare that income. With standard-cost, when you charge more than the IRD figures you may have to pay tax. If you claim for losses, you return must not only show all payments receive, but list actual costs, backed up by full documentation (this is called the actual-cost method).

Actual-cost method

Your tax position is unequivocal if you have five or more boarders – you must report that income. If you and your spouse or partner have boarders and tax is payable, the person who’s most directly involved each day should declare that income. If you get your rental income in advance, it’s taxable in the year in which you receive it.

Owning property for generating rental income is not, usually, classified as carrying on a business, but you may deduct related expenses. Those include:

• Rates and insurance

• Interest

• Fees or commission

• Repairs and maintenance

• Related motor vehicle and travel expenses

• Mortgage repayment insurance

• Accounting costs for preparation of related accounts

• Depreciation

Rental property expenses should still be deductible even when the property is temporarily vacant. If you have any questions or issues contact your manager here at A4. We are happy to help!