The government is currently considering new interest limitation rules. These will reduce the ability of residential investment property owners to claim interest as a deductible expense.

They are expected to be passed into law mid to late March 2022 and will be backdated to apply from 1 October 2021 for:

- Residential property acquired on or after 27 March 2021, interest cannot be claimed as an expense from 1 October 2021, unless an exclusion or exemption applies.

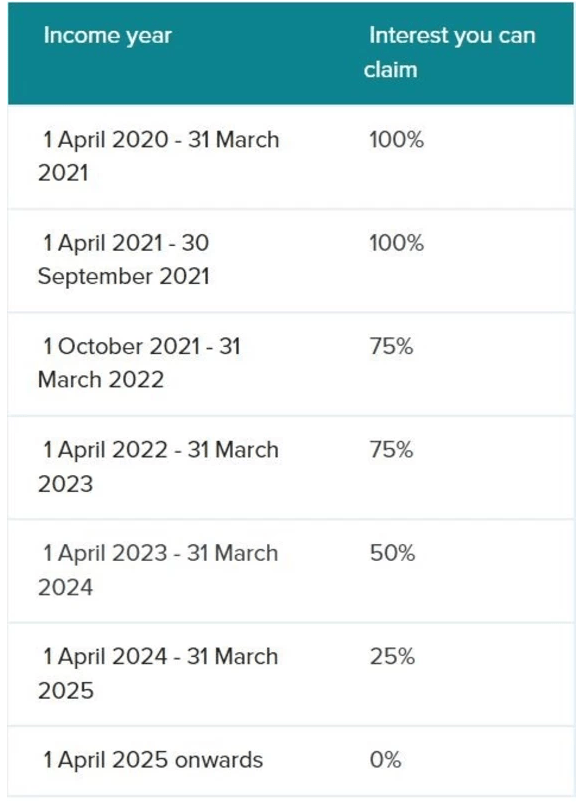

- Property acquired before 27 March 2021, the ability to deduct interest on existing loans is being phased out over 4 years, ending 31 March 2025 (see the image below). Interest deductions for any new loans drawn down on or after 27 March 2021 won't be allowed from 1 October onwards.

Some types of residential accommodation will be excluded from the interest limitation rules, such as:

the main home (if used to earn income)

- business premises

- farmland

- various accommodation providers.

For more information please get in touch with your accountant OR click here